After the Surge, a Cooldown: What's Next for San Diego Real Estate?

After the Surge, a Cooldown: What's Next for San Diego Real Estate?

San Diego Housing Market Update – Week Ending July 27, 2025

After last week’s dramatic post-holiday rebound, the San Diego housing market appeared to take a collective breather this week. The surge of new listings from the prior week cooled off, and buyer activity also tapped the brakes, with fewer homes going into escrow. This suggests both buyers and sellers are moving with a more measured, cautious pace. However, the dominant story remains unchanged: housing inventory is still dramatically higher than it was last year, continuing the market’s steady shift in the buyers' favor. This aligns with typical seasonal patterns, and barring any major shifts in interest rates or the economy, it's a trend I expect to see continue for the remainder of the year. Let's look at the numbers.

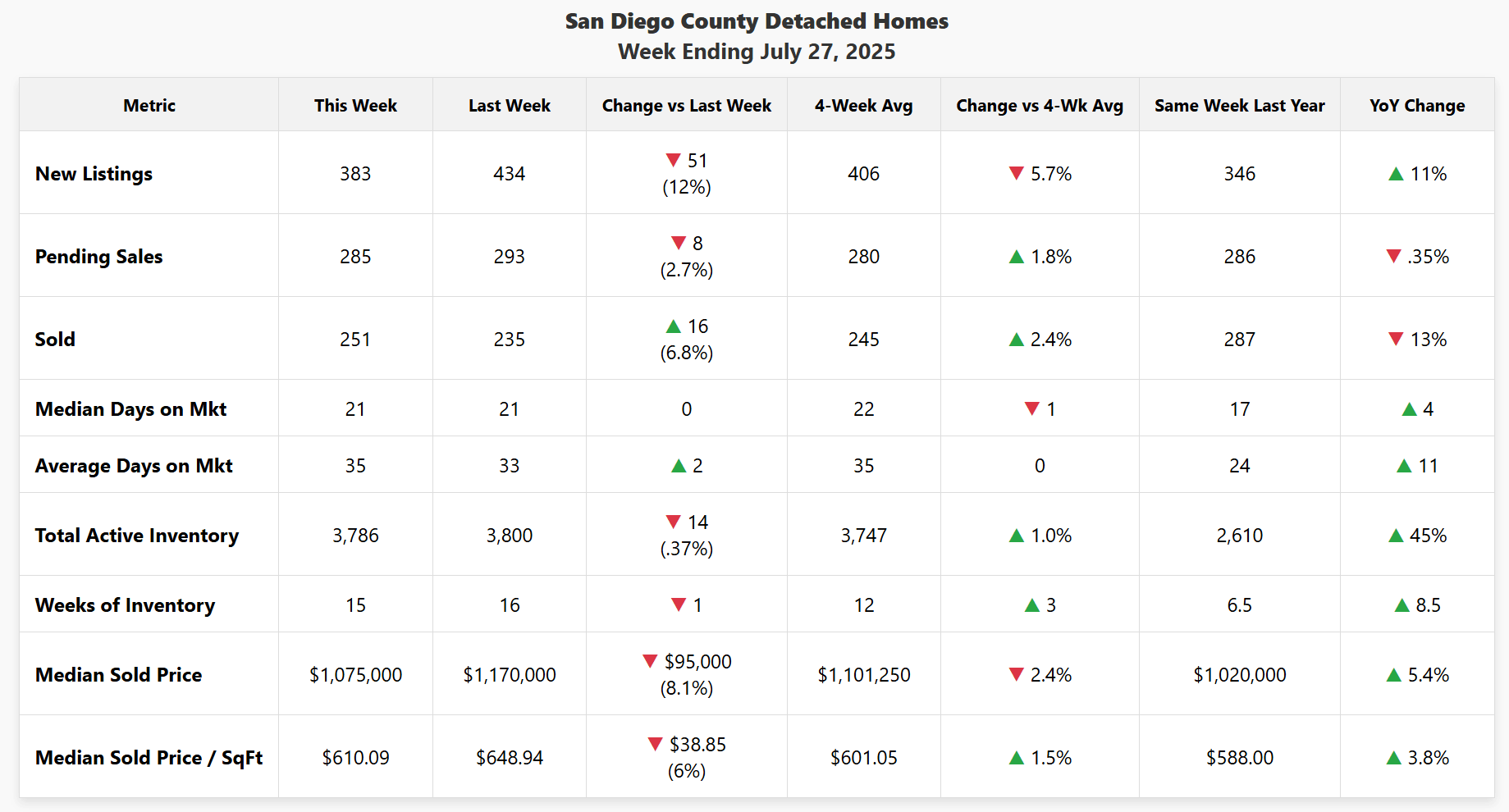

🏠 DETACHED HOMES – Week Ending July 27, 2025

Data for San Diego County detached single-family homes. Source: SDMLS | Analysis by Matt O'Brien, Realtor.

This week, single-family home sellers pulled back from last week’s frantic pace, with new listings dropping by 12%. Buyer activity followed suit, with pending sales dipping a slight 2.7%. This cooling of both supply and demand suggests the market is settling after the recent holiday volatility. While the weekly activity slowed, the bigger picture remains clear: there are 45% more homes for sale now than there were during the same week in 2024.

This sustained high inventory is continuing to affect how long it takes to sell a home, with the median time on market now at 21 days, compared to just 17 days last year. The most reliable long-term price indicator—the year-over-year median sold price—still shows a healthy 5.4% gain, but the pressure from the high inventory is undeniable and will be the key factor to watch moving forward.

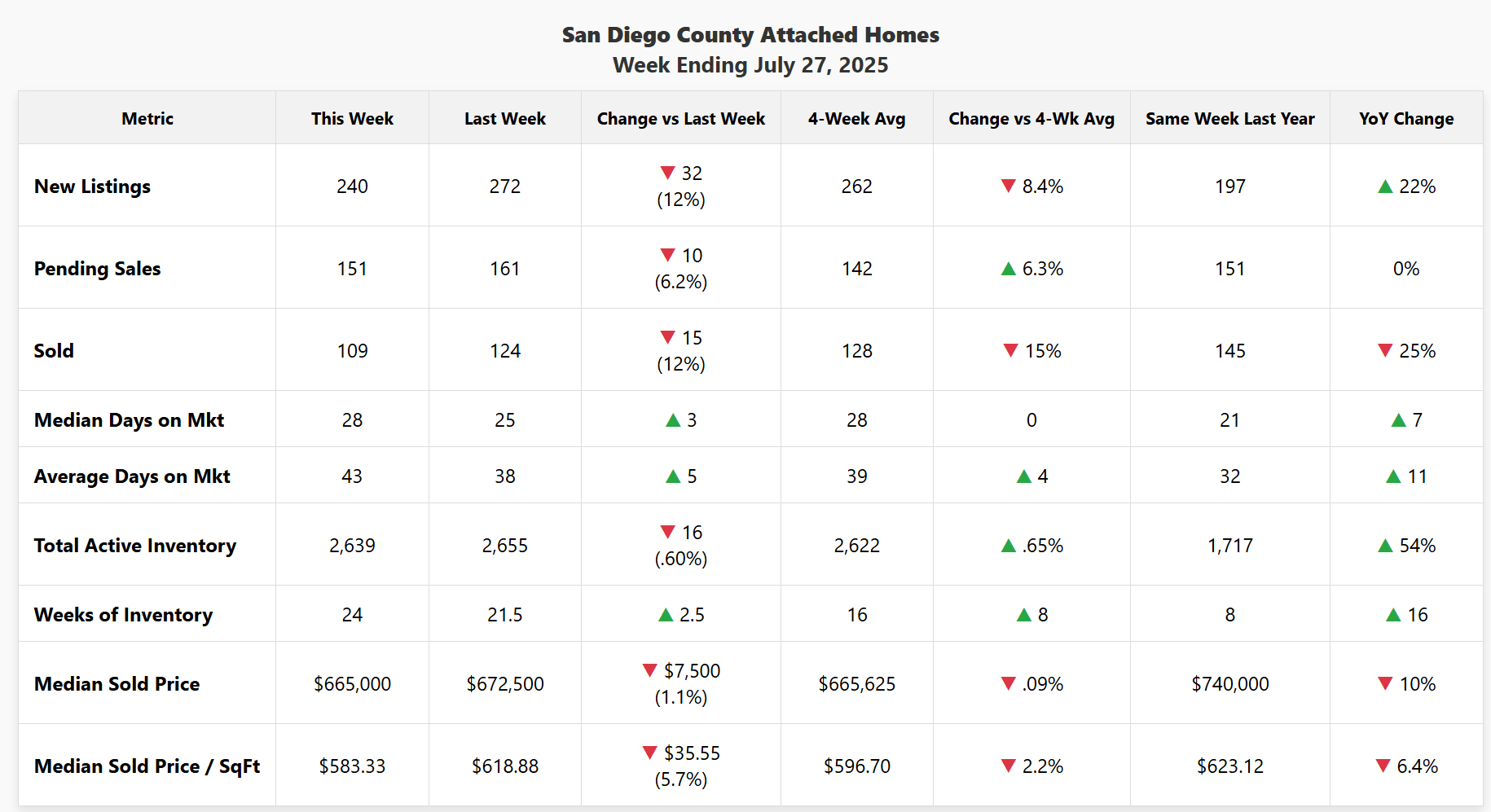

🏢 ATTACHED HOMES (Condos/Townhomes) – Week Ending July 27, 2025

Data for San Diego County attached homes (condos/townhomes). Source: SDMLS | Analysis by Matt O'Brien, Realtor.

The attached market saw a similar cooldown, with both new listings (-12%) and pending sales (-6.2%) declining this week. With inventory holding steady at a massive 54% above last year's levels, the story for condos and townhomes is one of abundant choice for buyers.

This is having a clear and significant impact on prices when viewed year-over-year. The median sold price of $665,000 is now down a full 10% from the same week in 2024. This trend suggests that this segment of the market is feeling the pressure from high inventory and shifting buyer sentiment even more profoundly than the detached market.

💡 What This Means for You

🔵 For Buyers

The market continues to shift in your favor. High inventory levels give you significant leverage, and this week's cooldown in activity means you're likely to experience less of a frenzy when viewing properties. This is a favorable environment for being selective and negotiating from a position of strength.

🟢 For Sellers

This week is another clear signal that the market is not what it was 12 months ago. With buyer activity softening and inventory remaining high, pricing your home correctly from the very beginning is the most critical component of a successful sale.

🟠 For Homeowners

The rapid appreciation seen over the last few years has stalled and is now showing signs of reversal, especially in the attached market. Your long-term equity is still strong, but it's crucial to adjust expectations for equity growth in the short term.

💰 For Investors

This week’s data points to a potential shift in the investment landscape. The significant 10% year-over-year price correction in the attached-home market, combined with high inventory levels, could present acquisition opportunities for those with a long-term strategy. With less competition, finding properties that pencil out for rental income may become easier. However, the overall market cooldown suggests that short-term flip strategies carry increased risk.

📞 Ready to Make Your Move?

A shifting market creates uncertainty, but it also creates opportunity. Having a clear, data-driven strategy is the key to success. If you're ready to make sense of these changes and build a plan that works for you, let's connect.

Let's Talk Strategy

Categories

Recent Posts