San Diego Housing: Decoding the Market's New Rhythm After Holiday & Fed News

San Diego Housing: Decoding the Market's New Rhythm After Holiday & Fed News

San Diego Housing Market Update – Week Ending September 21, 2025

After last week's post-Labor Day surge in buyer activity, the San Diego real estate market for the week ending September 21, 2025, shows signs of normalization. While new listings saw a healthy increase for detached homes, newly pending sales pulled back slightly for both segments. This suggests that the initial rush of buyers returning after the holiday has settled, leading to a more balanced market rhythm.

A significant development last week was the Federal Reserve's rate cut announcement on Wednesday, September 17th. While the perception of a rate cut often encourages buyers and could fuel increased activity, it's important to note that such expectations are frequently "baked into" mortgage rates well before the official announcement. Mortgage rates themselves have largely held steady, but the news may still influence buyer sentiment. We expect to see the full impact on pending sales reflected in next week's data. For the current week, however, other metrics indicate a resilient market: newly sold homes saw an increase, and median sold prices remained largely stable for detached homes while adjusting for attached properties.

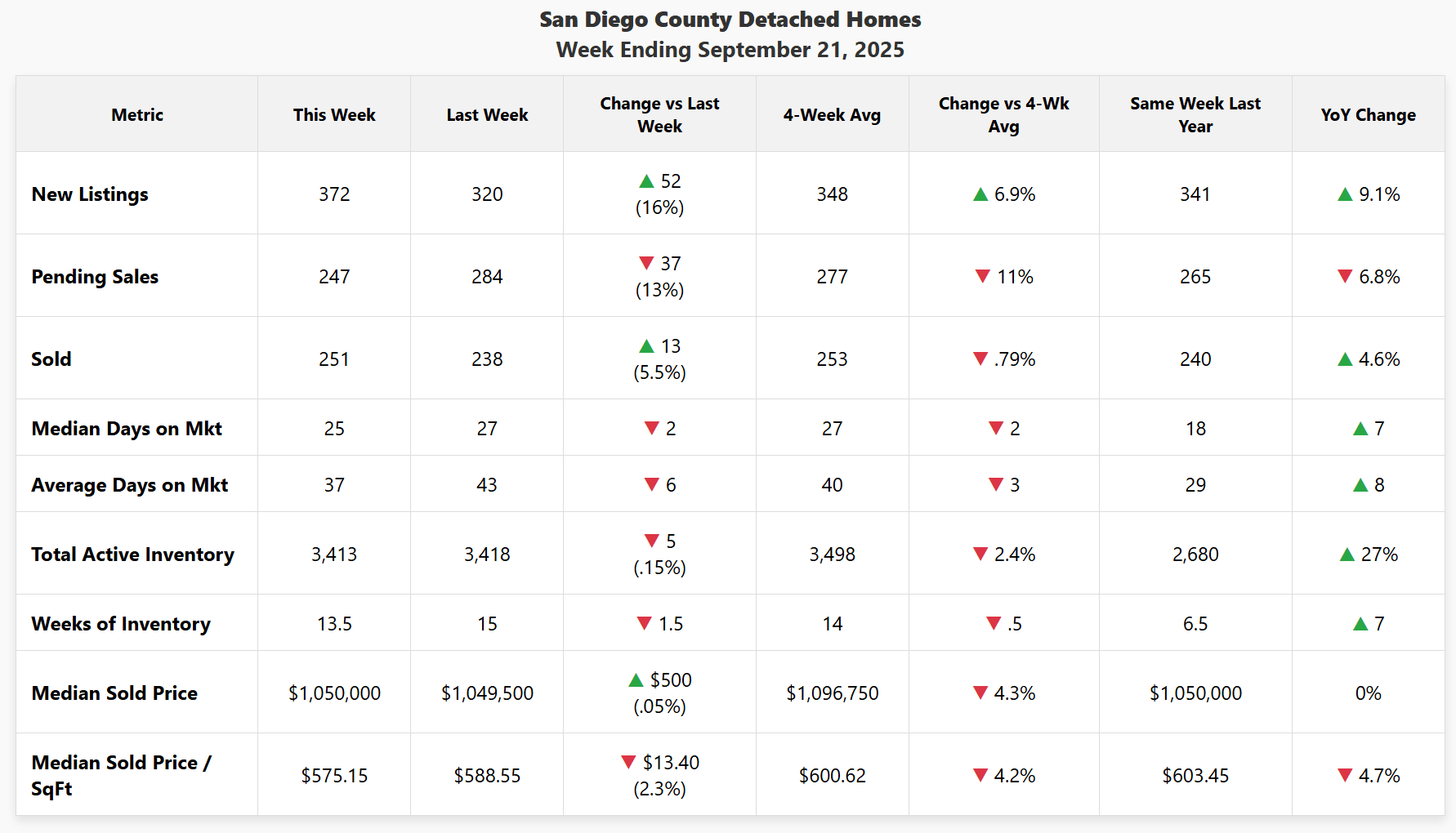

🏠 DETACHED HOMES – Week Ending September 21, 2025

Data for San Diego County detached homes for the week ending September 21, 2025. Source: SDMLS | Analysis by Matt O'Brien, Realtor.

For detached homes, new listings increased by a healthy 16% this week, bringing more options to buyers. However, newly pending sales saw a 13% dip after last week's strong rebound, settling closer to numbers from this time last year. This indicates a normalization of buyer activity rather than a significant slowdown. On a positive note, newly sold homes increased by 5.5%, suggesting successful closings from previous weeks. Median sold prices remained stable, virtually unchanged from last week and matching last year's figures, indicating consistent value.

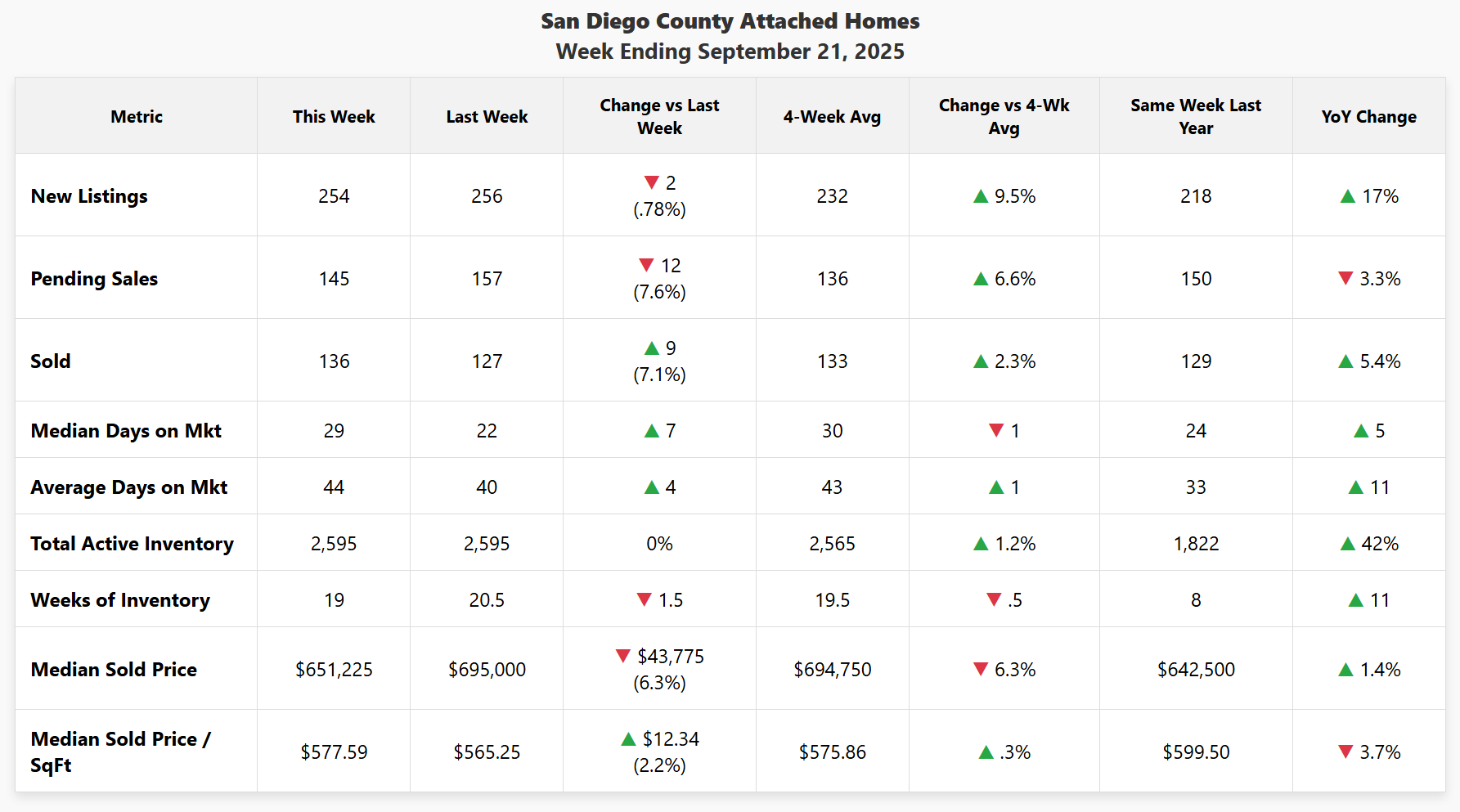

🏢 ATTACHED HOMES (Condos/Townhomes) – Week Ending September 21, 2025

Data for San Diego County attached homes for the week ending September 21, 2025. Source: SDMLS | Analysis by Matt O'Brien, Realtor.

The attached market also saw pending sales pull back by 7.6% this week, normalizing after last week's dramatic 55% jump. Despite this, newly sold homes increased by 7.1%, demonstrating continued closings. Active inventory remained flat week-over-week, maintaining a steady supply. The median sold price adjusted by 6.3% from last week's higher figures, returning closer to the four-week average and still showing a slight increase year-over-year. Median days on market increased, suggesting that buyers are taking a bit more time with their decisions.

💡 What This Means for You

🔵 For Buyers

The market is taking a breath after a busy post-holiday period. While pending sales eased, this could mean slightly less immediate competition for available listings. With new listings up in the detached market, more options are appearing. Crucially, while the Fed's rate cut may have been largely baked into mortgage rates, the positive sentiment it creates could still spur more activity, so now is a key time to prepare your strategy.

🟢 For Sellers

The surge of buyers from last week has found its rhythm, but the recent Fed rate cut, even if largely anticipated, is a positive signal for renewed buyer sentiment. While pending sales pulled back this week, sold numbers are still strong. This suggests that properly priced and well-presented homes are still moving. Remember that the increase in closed sales is typically reflective of market activity 4-6 weeks ago. Focus on competitive pricing and highlighting your home's unique value to attract serious buyers as the market re-calibrates.

🟠 For Homeowners

The market is stable and continues to see activity, even if the pace has moderated slightly. Your home's equity remains resilient, particularly for detached properties holding median prices steady year-over-year. Remember that the increase in closed sales is typically reflective of market activity 4-6 weeks ago. The Fed's rate cut offers positive long-term implications for market stability and buyer confidence, even if its direct, immediate impact on mortgage rates was minimal.

💰 For Investors

The market's normalization presents a more measured environment, but the recent Fed rate cut could invigorate buyer confidence in the coming weeks due to perception. Increased new listings offer more potential properties, and adjusting prices in the attached market could create new entry points. Keep an eye on how the market responds to the new rate environment for strategic acquisitions.

📞 Ready to Make Your Move?

The San Diego real estate market is dynamic and constantly evolving, with recent Fed decisions influencing buyer sentiment. Staying informed with the latest data and understanding broader economic influences is key to making smart decisions. If you're ready to explore your options, whether buying, selling, or investing, let's connect and strategize.

Let's Talk StrategyCategories

Recent Posts