The "Holiday Rebound" is Real (But Don't Let the Numbers Fool You)

Week Ending December 7, 2025

If you glanced at the raw data this week, you might think the San Diego housing market just drank a double espresso. New Listings skyrocketed 152% for detached homes and 123% for condos compared to the previous holiday week.

But here is the context you need: This isn't a sudden flood of new inventory; it’s the "Thanksgiving Rebound."

Activity naturally plummeted during Turkey Day week. As we rolled into December, sellers who waited—or agents who withdrew listings to re-list them as "fresh" after the holiday—pushed the "Go" button. Despite this surge in new activity, the broader trend is undeniable: Total Active Inventory is shrinking. We are in the thick of our traditional seasonal decline, meaning serious buyers have fewer options, but the ones remaining are motivated.

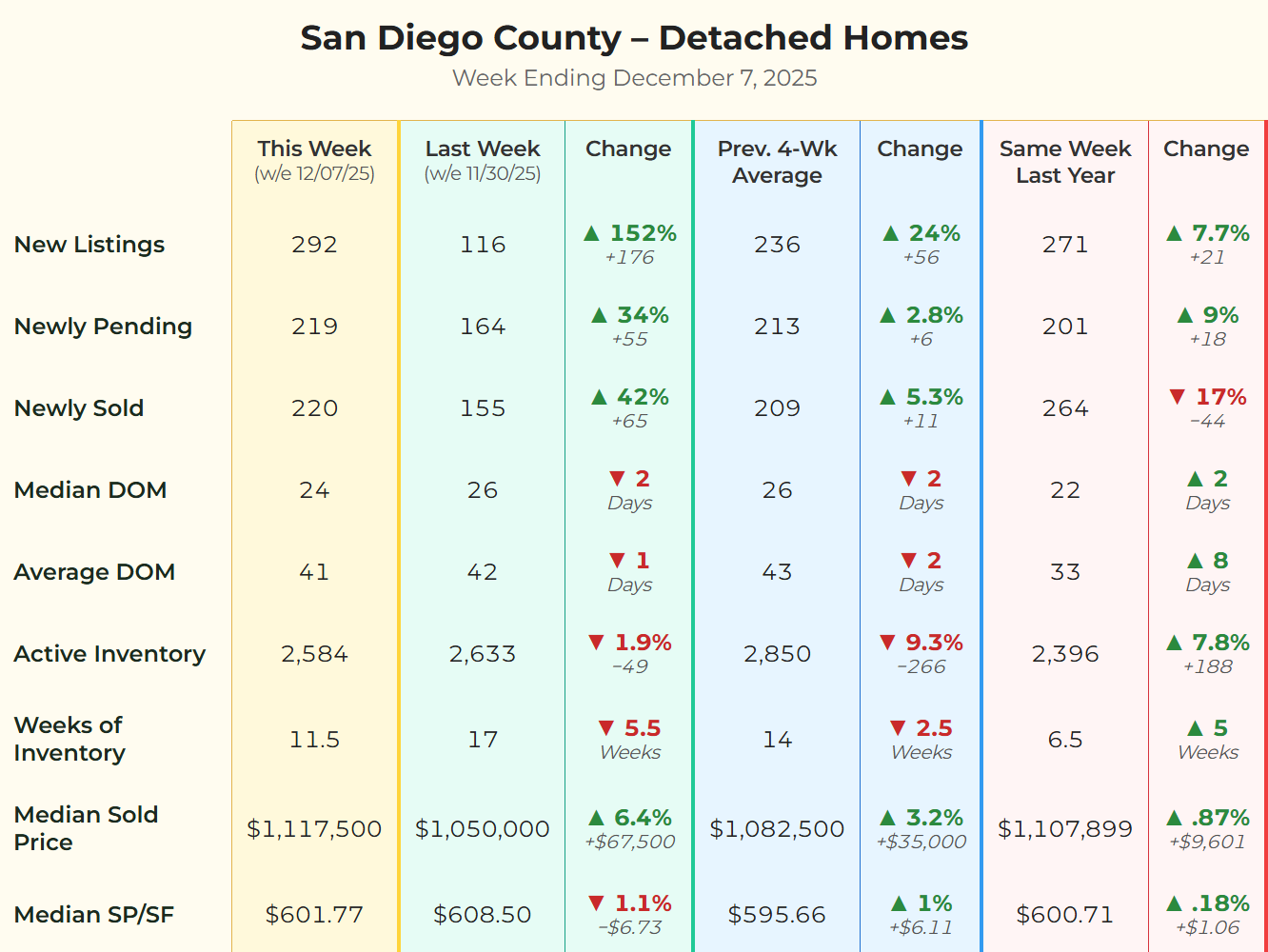

Here is what the data says for the first week of December.

🏠 DETACHED HOMES: The Inventory Squeeze Continues

The headline number is the massive jump in New Listings (292), up from just 116 the week prior. However, look at the Active Inventory count: it dropped from 2,633 down to 2,584.

How do we add nearly 300 homes but end up with fewer for sale? Two reasons:

- High Absorption: Pending sales jumped 34% this week. However, to keep this in perspective, the 4-Week Rolling Average for pending sales is up a more modest 2.8%. This indicates that while we definitely bounced back from the holiday slump, the overall market pace is steady rather than exploding.

- Seasonality: We are seeing the typical end-of-year consolidations where unsold homes are pulled off the market.

Pricing Trends:

Prices remain resilient. The 4-Week Rolling Average for sold prices ticked up 3.2% to $1,082,500. When we look at the pending data (the leading indicator of where we are heading), the median list price for homes under contract is hovering around $1.049M, suggesting the market is finding equilibrium just above that $1M mark.

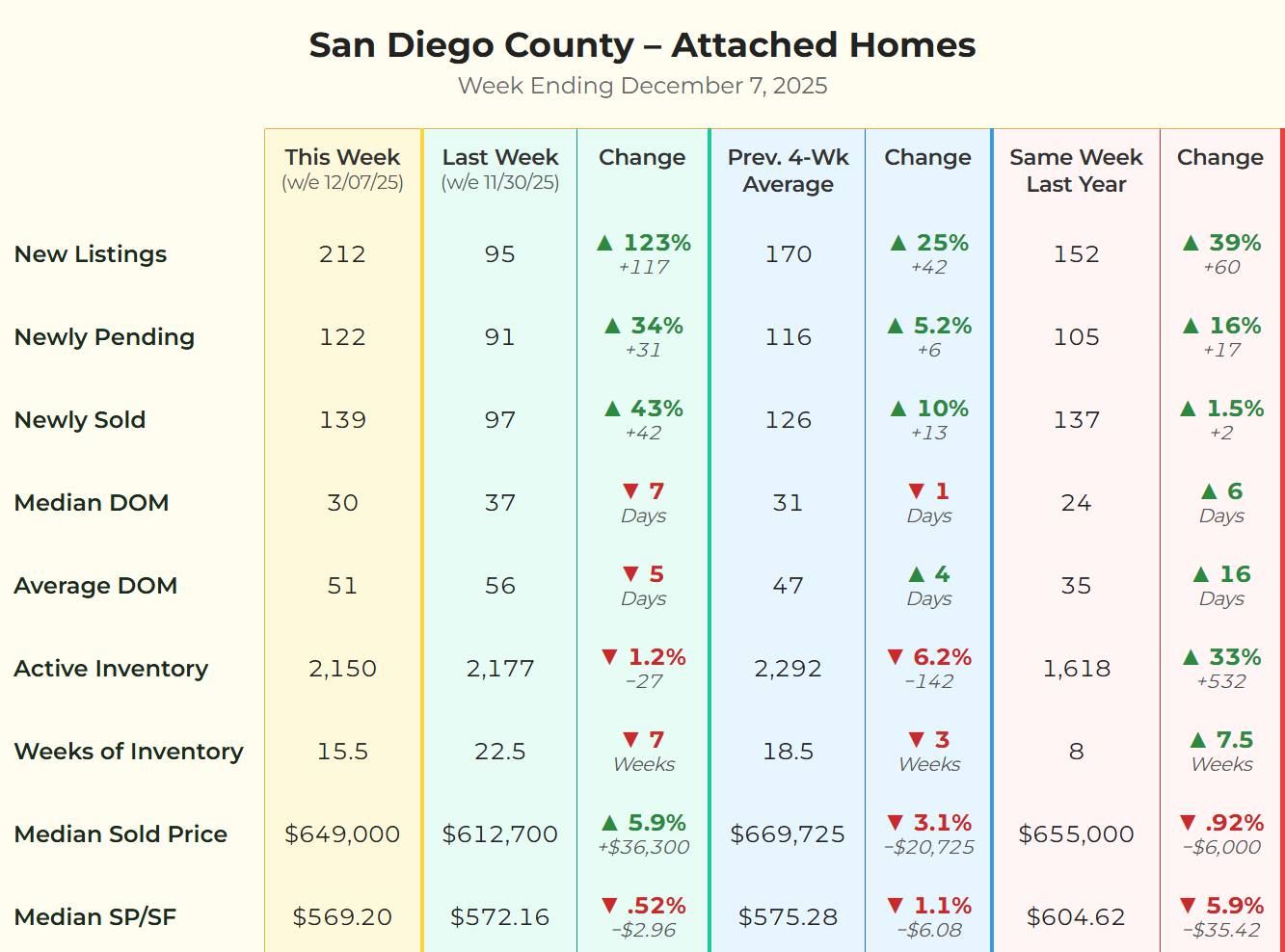

🏢 ATTACHED HOMES: A Similar "Sugar Rush"

The attached market (condos/townhomes) mirrored the detached sector almost perfectly. New Listings surged 123%, yet total Active Inventory fell by nearly 30 units to 2,150.

The Weeks of Inventory (a key measurement of supply vs. demand) tightened significantly, dropping from 22.5 weeks down to 15.5 weeks. While that is still a "buyer's market" statistically, the sudden drop indicates that the holiday lull in buyer activity was short-lived.

Pricing Trends:

Unlike detached homes, the attached sector is seeing some softness. The 4-Week Rolling Average for sold prices dipped 3.1% to $669,725. With inventory significantly higher than last year (+33% YoY), condo buyers currently have more leverage to negotiate than single-family buyers.

💡 What This Means For You

🛒 For Buyers

Don't let the "New Listing" tag fool you. While there are certainly genuine new listings hitting the market, a significant portion of this week's "new" inventory is likely recycled listings. These sellers are trying to look fresh to compete with the newly launched homes for the year-end sprint. That said, with interest rates still volatile (check Mortgage News Daily for the latest), the window to buy without intense competition is narrowing as inventory shrinks. If you see a home you like, the "wait and see" strategy is risky right now.

💰 For Sellers

If you didn't sell before Thanksgiving, you are now in the unique "Holiday Window." Serious buyers are still out there (evidenced by the jump in pending sales), but they are looking for value. The data shows that correctly priced homes are still moving—detached homes are selling in a median of 24 days. If you are on the market now, you need to be priced to sell before the New Year or you risk stagnating.

🪺 For Homeowners

Your equity is holding strong. Despite the seasonal slowdown in volume, detached home prices are trending up slightly compared to last month. The market is behaving exactly as we expect for December: quiet on the surface, but steady underneath.

📞 Ready to Make Your Move?

Whether you are looking to snag a deal before the end of 2025 or prepping your home for the 2026 spring market, you need a strategy based on data, not headlines.

Let’s look at your specific neighborhood numbers.

P.S. Don't wait until spring to start preparing. Historical data for San Diego shows that hitting the market fresh and ready in early spring (often as early as March) is the best time to maximize your results.

Categories

Recent Posts