The Thanksgiving "Skew": Why San Diego’s Housing Numbers Just Took a Nosedive

The Thanksgiving "Skew": Why San Diego’s Housing Numbers Just Took a Nosedive

Week Ending November 30, 2025

The "Turkey Coma" is Real in the Data

If the numbers below look shocking, don't panic. You are looking at the "Thanksgiving Skew."

This week’s data is heavily distorted by the holiday. Between travel, hosting visitors, and the traditional retail frenzy of Black Friday, real estate took a back seat for most San Diegans. We see this every year: new listings and pending sales plummet as the county takes a collective pause.

However, we have a unique advantage in the data this week. Thanksgiving fell during this exact same week (Week 48) last year, whereas in 2023 it was a week earlier. This gives us a rare, perfect "apples-to-apples" comparison. While the week-over-week drops are drastic, the year-over-year numbers tell the true story of how 2025 compares to 2024 during the quietest week of the year.

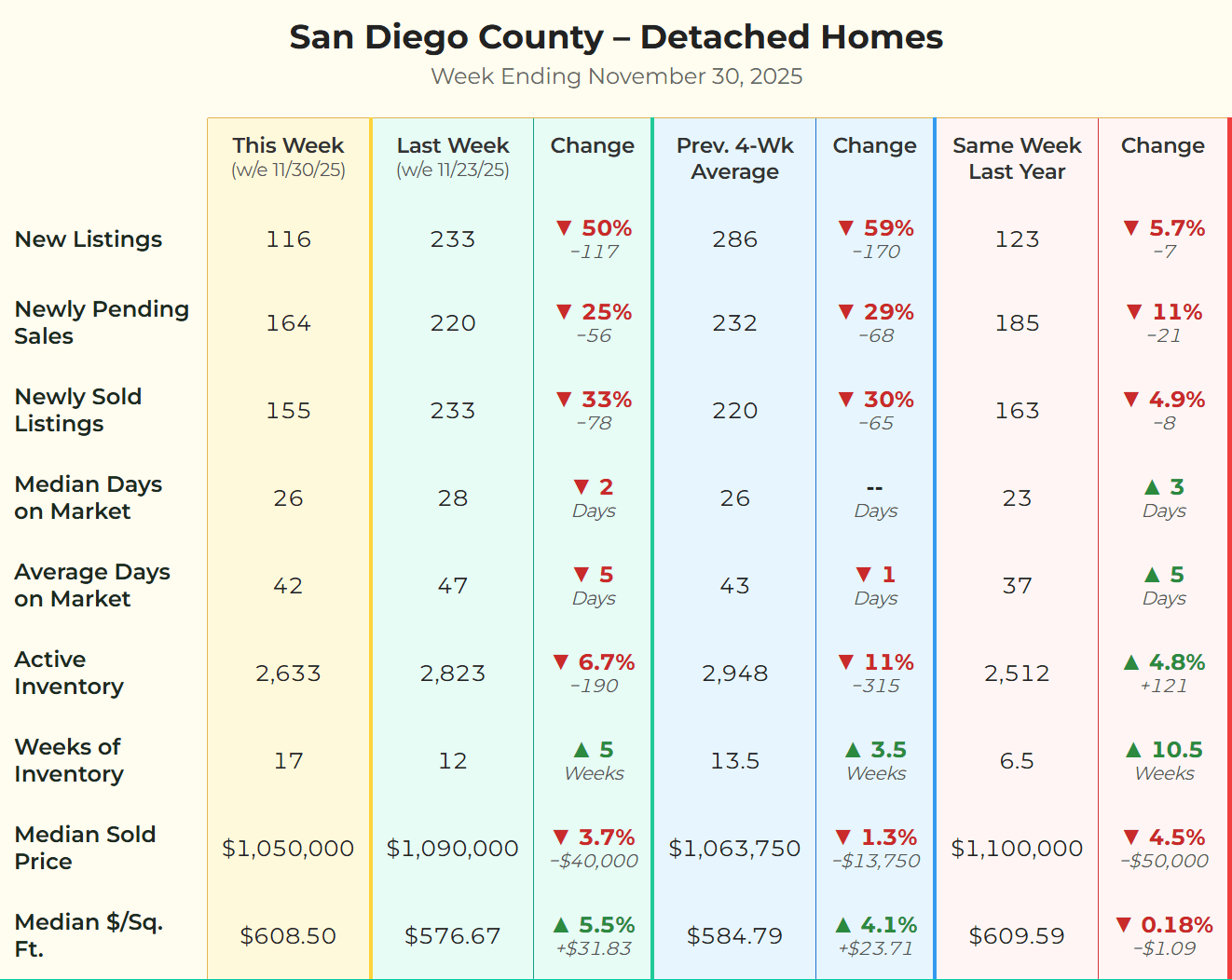

🏠 DETACHED HOMES: The Pause Button Was Hit Hard

As expected, the detached market went into hibernation.

- Listings Vanished: New listings dropped by 50% compared to last week, landing at just 116 homes. This is nearly identical to the drop we saw during Thanksgiving week last year (123 listings).

- Sales Slowed: Newly pending sales fell 25% to 164. Again, this is typical for the holiday; nobody wants to negotiate a contract while carving a turkey.

- Pricing Trend: The 4-Week Rolling Average for median sold price is $1,063,750. This is a slight dip from recent weeks but remains the most reliable indicator of value amidst the holiday noise. Interestingly, this 4-week average is slightly lower than the single-week median we saw at this time last year ($1,100,000), suggesting some softness in pricing power as we close out the year.

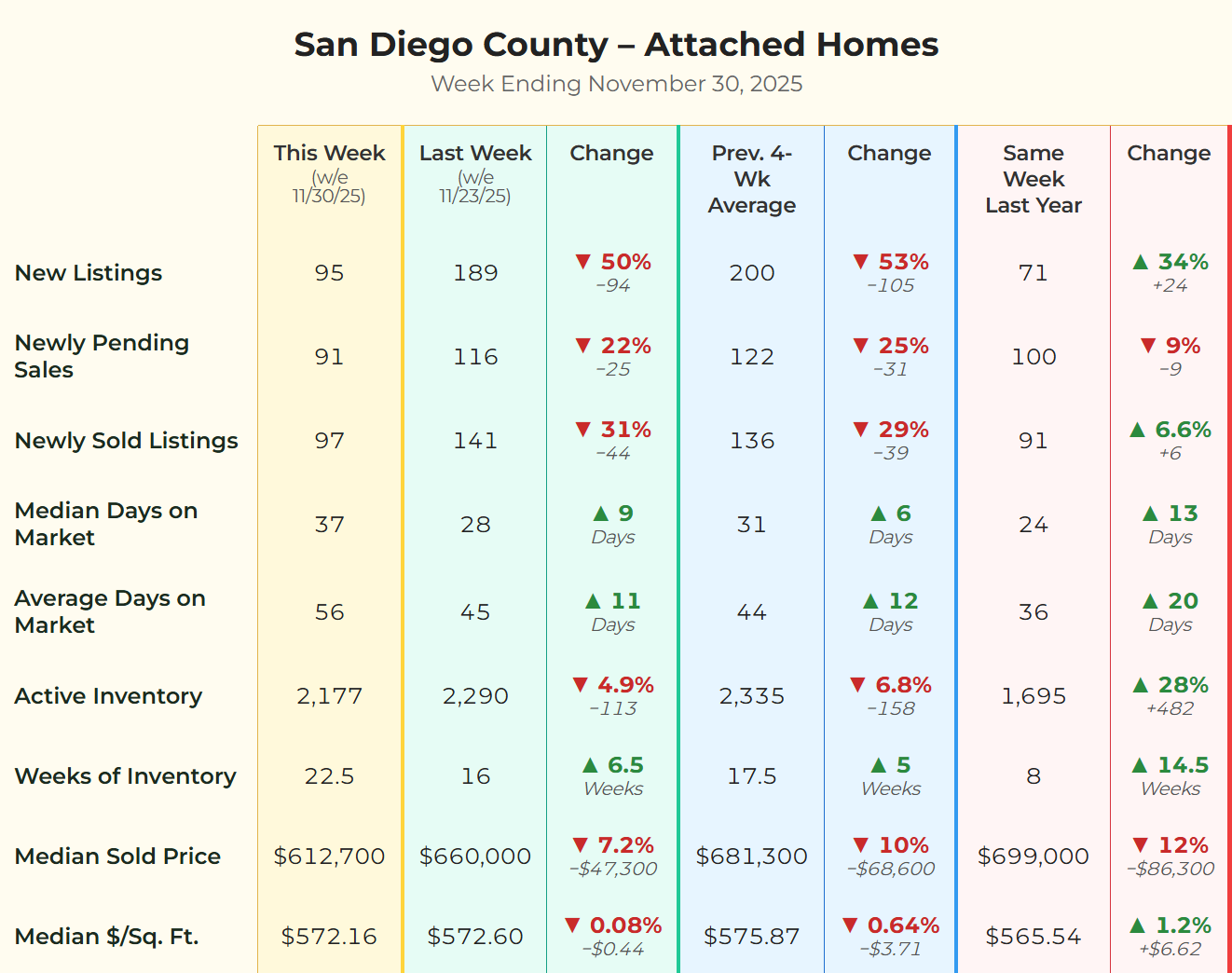

🏢 ATTACHED HOMES: A Surprising Spark of Activity

While detached homes followed the script, the condo and townhome market offered a surprise.

- More Options than 2024: While new listings dropped 50% from last week (to 95 units), this is actually a 34% increase compared to the same holiday week last year (which had only 71 listings). Even during the holiday lull, condo inventory is building more momentum than it did in 2024.

- Pending Sales: Pending sales dipped 22% to 91, closely tracking the drop in detached homes.

- Pricing Trend: The 4-Week Rolling Average for attached homes is $681,300. Prices here have softened recently, with the 4-week average sitting below the $700k mark we saw earlier in the fall.

💡 What This Means For You

🛒 For Buyers

The "holiday lull" is your best friend. Competition has evaporated, and sellers who are still active right now are serious—they aren't testing the market for fun during Thanksgiving. With mortgage rates hovering in the low 6% range (check the latest at Mortgage News Daily), this quiet period before the New Year is often the best time to negotiate a deal without a bidding war.

💰 For Sellers

Don't let the red arrows on the chart scare you. The drop in activity is purely seasonal. We expect these numbers to remain skewed into next week as the "holiday hangover" clears. If you are on the market, patience is key. The buyers looking right now are highly motivated, even if there are fewer of them.

🪺 For Homeowners

This week is a reminder that real estate is hyper-seasonal. The fluctuations we see in November and December are predictable. The more important metric is the year-over-year health, and despite the holiday dip, the market remains fundamentally stable with inventory levels that are slowly normalizing.

📞 Ready to Make Your Move?

Whether you're looking to buy during the holiday quiet or prepping to sell in the New Year, you need a strategy that fits the season. Let’s look at your specific numbers.

Categories

Recent Posts