SAN DIEGO REAL ESTATE ~ A FALL REFRESH TAKES SHAPE ~ WEEK ENDING OCTOBER 6, 2025

San Diego Real Estate: Crisp Air, Fresh Listings? Decoding October's Market

San Diego Housing Market Update – Week Ending October 5, 2025

As October unfolds, that crisp, cool autumn air here in San Diego. It often feels like a fresh start, right? Well, something similar is happening in our housing market this past week!

At first glance, I was surprised to see such a big jump in new listings hitting the market, because this is usually the time of year when new listings tend to slow down. As I continued pulling the data for my charts, I quickly realized that what looked "new" wasn't what it seemed...

While many homes appeared to be new listings, the number of homes going under contract (pending sales) actually dipped from last week and the total active inventory across San Diego edged only slightly lower than last week. This combination tells me that many of those so-called new listings were actually stale listings being pulled off of the shelf, dusted off, and perhaps being rebranded as new, maybe with a few updates, newer pictures, and/or a fresh new marketing price.

The goal? To make a refreshed appearance on search portals and agent alerts, hoping to grab the attention of newer buyers, or perhaps even those who showed interest before but didn't act at the original price. It's a clever way sellers try to keep their homes active in buyers' minds and avoid them looking "stale." It's kind of like a seller waiving their hand and saying "I'm here!" 👋😅

Let's break down what the numbers say and how this week compares to recent trends and last year...

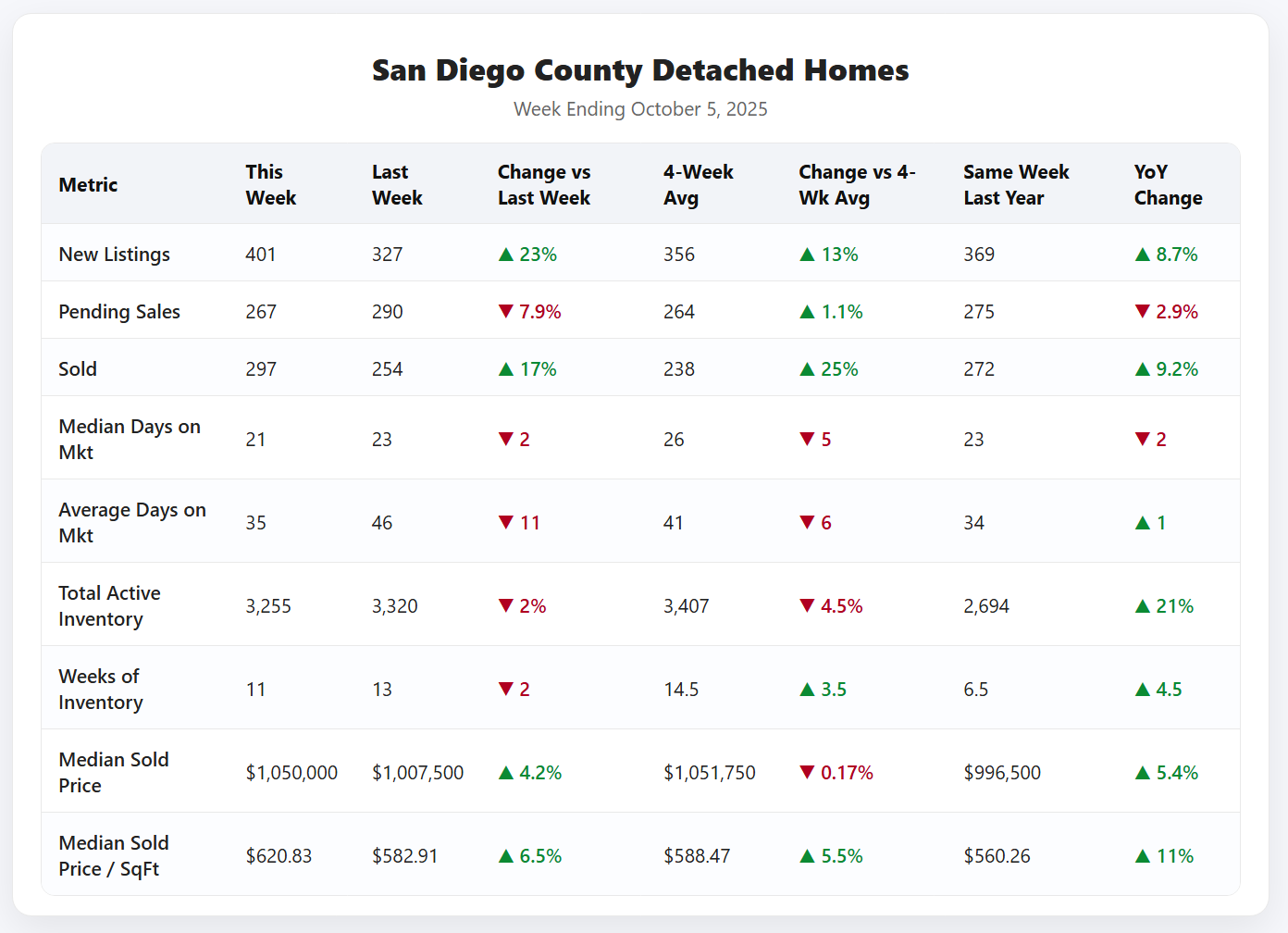

🏠 DETACHED HOMES – Week Ending October 5, 2025

Data for San Diego County detached homes for the week ending October 5, 2025. Source: SDMLS | Analysis by Matt O'Brien, Realtor.

For detached homes, New Listings had a big 23% jump this week. But, as I just explained, with Active Inventory dipping slightly and Newly Pending Sales down 7.9% from last week (and also down 2.9% compared to October 2023), many of these are likely re-listed homes. Still, good news for sellers is that Newly Sold homes saw a strong 17% increase this week and are up 9.2% from last year, showing that homes are successfully closing. The Median Sold Price held steady at $1,050,000, which is great. It's up 4.2% from last week and a solid 5.4% higher than October 2023, proving that detached homes are keeping their value. Homes are also selling a little quicker, with Median Days on Market at 21, down 2 days from both last week and last year.

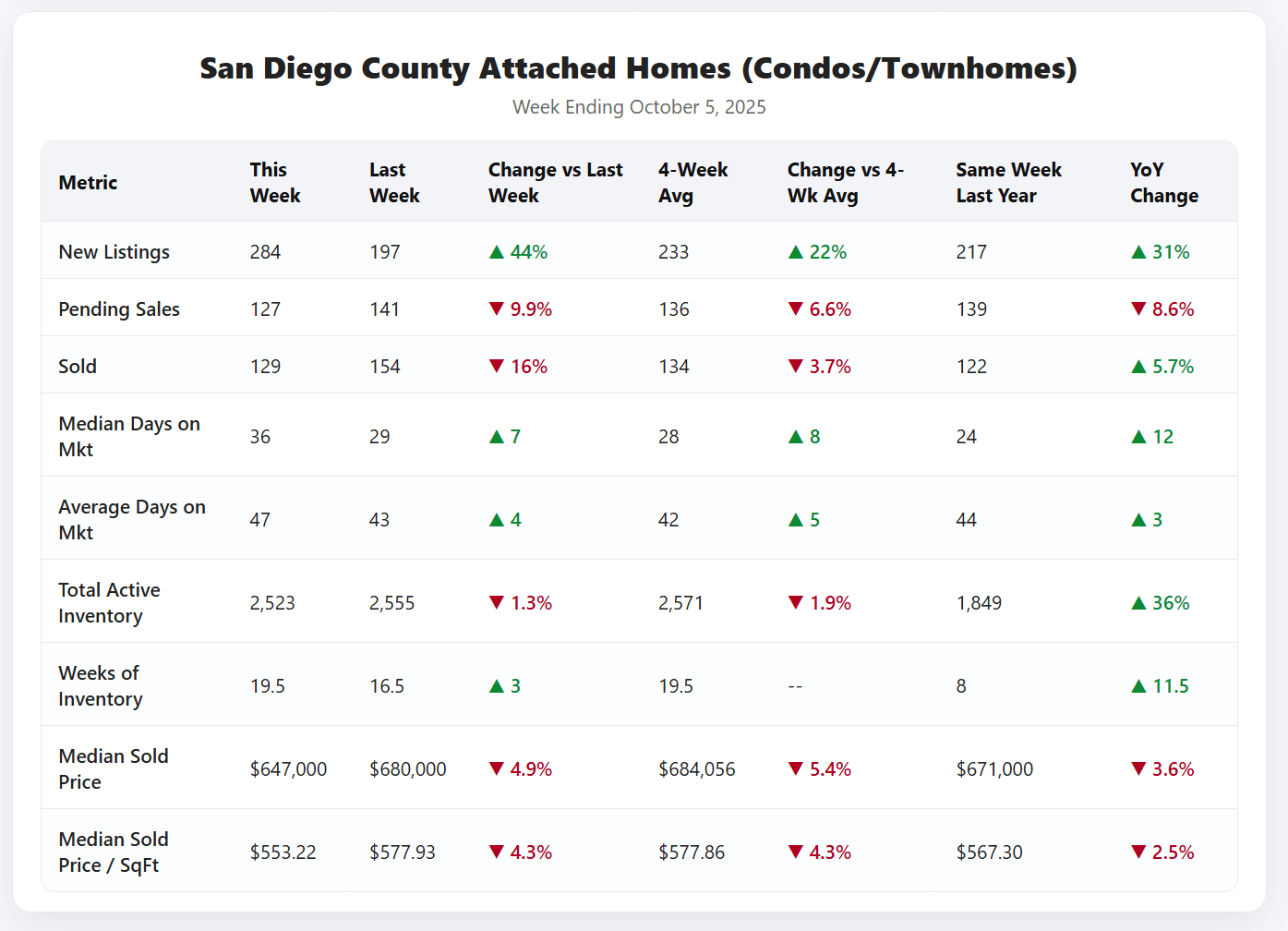

🏢 ATTACHED HOMES (Condos/Townhomes) – Week Ending October 5, 2025

Data for San Diego County attached homes for the week ending October 5, 2025. Source: SDMLS | Analysis by Matt O'Brien, Realtor.

The attached market also saw a very big 44% increase in New Listings this week, giving buyers many more options, and these listings are up 31% from October 2023. Just like with detached homes, the total Active Inventory is slightly down while Newly Pending Sales dropped by 9.9% this week (and are down 8.6% year-over-year). This strongly suggests that many of these are re-listed properties. Newly Sold homes were down 16% this week, but they're still up 5.7% compared to last year's numbers. The Median Sold Price adjusted by 4.9% to $647,000, and is now 3.6% lower than this time last year, showing some price adjustments. Overall Active Inventory for attached homes continues to grow, now a significant 36% higher than October 2023, offering a wider selection. Homes are also taking longer to sell, with Median Days on Market increasing by 7 days this week and up 12 days compared to last year.

💡 What This Means for You

🔵 For Buyers

The market is taking a breath after a busy post-holiday period. While pending sales eased, this could mean slightly less immediate competition for available listings. With new listings up in the detached market, more options are appearing. Crucially, while the Fed's rate cut may have been largely baked into mortgage rates, the positive sentiment it creates could still spur more activity, so now is a key time to prepare your strategy.

🟢 For Sellers

The surge of buyers from last week has found its rhythm, but the recent Fed rate cut, even if largely anticipated, is a positive signal for renewed buyer sentiment. While pending sales pulled back this week, sold numbers are still strong. This suggests that properly priced and well-presented homes are still moving. Remember that the increase in closed sales is typically reflective of market activity 4-6 weeks ago. Focus on competitive pricing and highlighting your home's unique value to attract serious buyers as the market re-calibrates.

🟠 For Homeowners

The market is stable and continues to see activity, even if the pace has moderated slightly. Your home's equity remains resilient, particularly for detached properties holding median prices steady year-over-year. Remember that the increase in closed sales is typically reflective of market activity 4-6 weeks ago. The Fed's rate cut offers positive long-term implications for market stability and buyer confidence, even if its direct, immediate impact on mortgage rates was minimal.

💰 For Investors

The market's normalization presents a more measured environment, but the recent Fed rate cut could invigorate buyer confidence in the coming weeks due to perception. Increased new listings offer more potential properties, and adjusting prices in the attached market could create new entry points. Keep an eye on why homes are being re-listed — it can tell you a lot about seller motivation.

📞 Ready to Make Your Move?

The San Diego real estate market is dynamic and constantly evolving, with recent Fed decisions influencing buyer sentiment. Staying informed with the latest data and understanding broader economic influences is key to making smart decisions. If you're ready to explore your options, whether buying, selling, or investing, let's connect and strategize.

Let's Talk StrategyCategories

Recent Posts