A Rebound in Demand: Are Lower Rates or Seller Deals Driving the Market?

A Rebound in Demand: Are Lower Rates or Seller Deals Driving the Market?

San Diego Housing Market Update – Week Ending August 24, 2025

Just as the San Diego market seemed to be settling into a typical late-summer slowdown, buyers returned with surprising force this week. Bucking the seasonal trend, the number of single-family homes going under contract surged by 16%, and the median sold price jumped right along with it. This unexpected wave of activity suggests that the market's "cooldown" may have been a brief pause rather than a sustained trend. This renewed optimism comes as mortgage rates have shown signs of stabilizing. According to recent data from Mortgage News Daily, 30-year fixed rates have held steady in the mid-6% range, which may be providing the confidence boost buyers needed to re-engage.

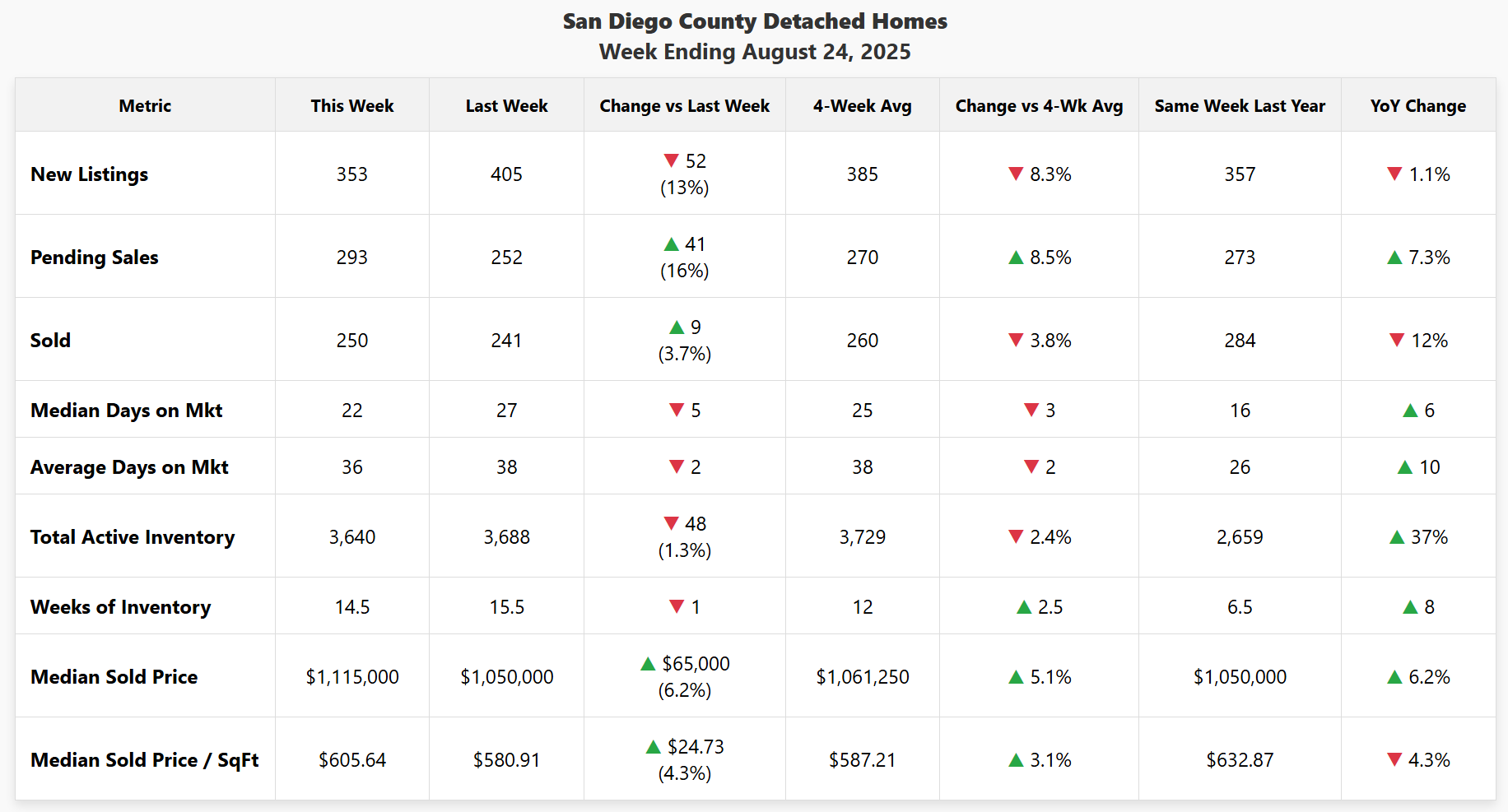

🏠 DETACHED HOMES – Week Ending August 24, 2025

Data for San Diego County detached homes for the week ending August 24, 2025. Source: SDMLS | Analysis by Matt O'Brien, Realtor.

The big story for detached homes is the powerful rebound in buyer activity. Pending sales, the most reliable indicator of current demand, jumped an impressive 16% week-over-week. This surge of activity translated directly to seller success, as the median sold price also climbed a strong 6.2% for the week, reaching $1,115,000. This also marks a 6.2% gain compared to the same week last year, a very strong signal of market health. This is all happening in a market that still has 37% more inventory than it did a year ago, suggesting that motivated buyers are actively absorbing the available homes.

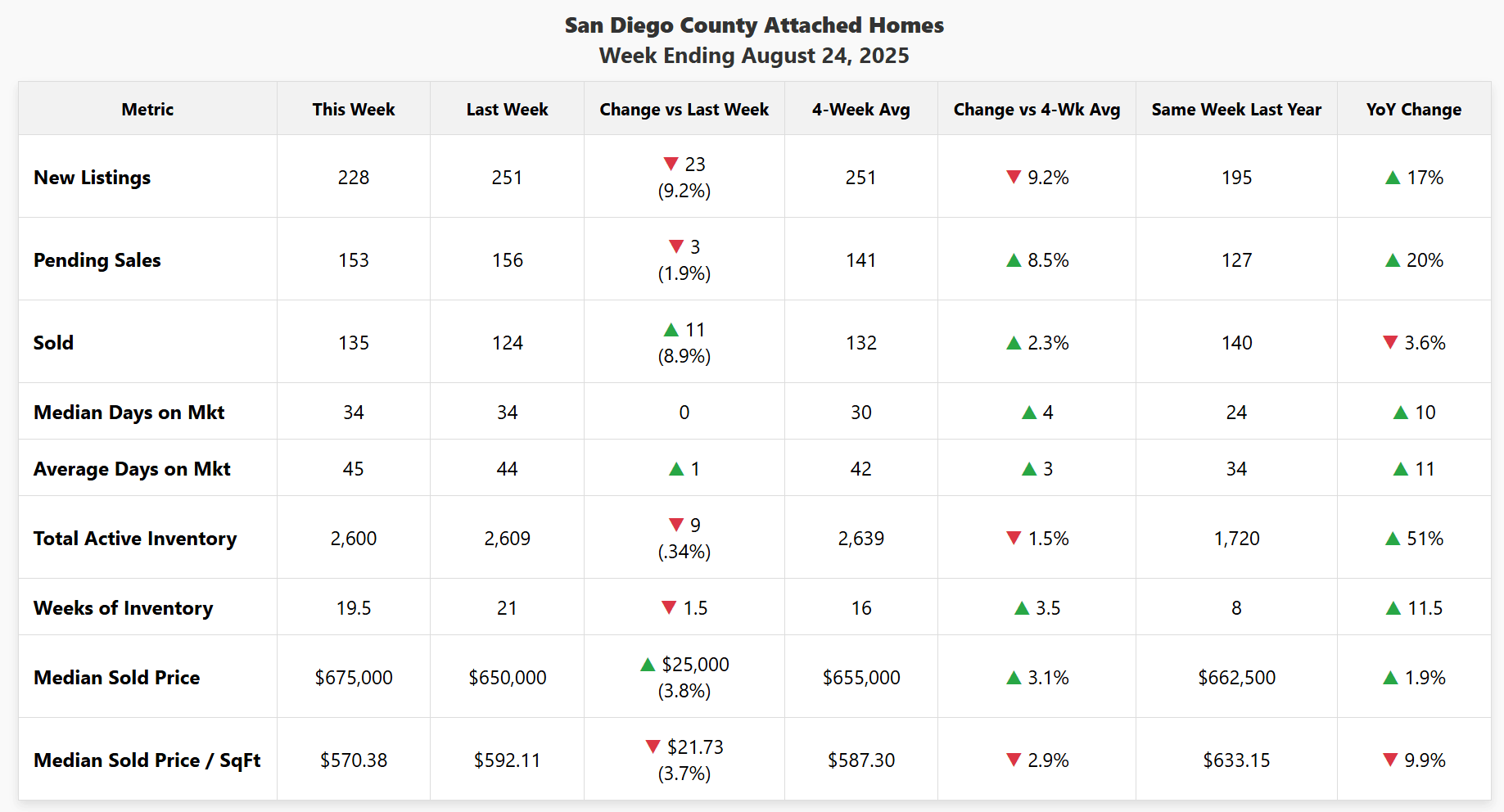

🏢 ATTACHED HOMES (Condos/Townhomes) – Week Ending August 24, 2025

Data for San Diego County attached homes for the week ending August 24, 2025. Source: SDMLS | Analysis by Matt O'Brien, Realtor.

The attached market showed more stability this week. After recent volatility, pending sales held steady, dipping by a negligible 1.9%. Even so, buyer demand remains strong, with 20% more homes going under contract now than during the same week in 2024. This consistent activity is supporting prices, which rose 3.8% for the week and are now up 1.9% year-over-year. In a market where affordability is paramount, the attached segment continues to show its strength and resilience.

💡 What This Means for You

🔵 For Buyers

This week's surge in activity and prices is a crucial reminder that while inventory is high, you are not alone. Competition for well-priced homes is heating up again. The high inventory still provides you with more choices than last year, but the window for making low-competition offers on the most desirable properties may be closing.

🟢 For Sellers

This is a very positive sign. The strong rebound in both buyer demand and prices suggests that the market has significant underlying strength. If you priced your home competitively, you are in a great position to attract interest from this wave of motivated buyers.

🟠 For Homeowners

The data this week is a strong affirmation of the value of San Diego real estate. The market's ability to absorb high inventory while still pushing prices higher is a sign of long-term health and desirability, which is great news for your home's equity.

💰 For Investors

The price appreciation in both market segments, coupled with a clear and resilient pool of buyer demand, reinforces the stability of San Diego real estate as a long-term investment. The data shows that even in a shifting national environment, local demand remains robust.

📞 Ready to Make Your Move?

A dynamic market like this creates incredible opportunities for those with the right strategy. Whether you're a buyer looking to take advantage of the high inventory or a seller ready to capture renewed demand, I can help you navigate the complexities. Let's connect.

Let's Talk StrategyCategories

Recent Posts