San Diego's End-of-Summer Surprise: Decoding the Holiday Weekend Data

San Diego's End-of-Summer Surprise: Decoding the Holiday Weekend Data

San Diego Housing Market Update – Week Ending September 1, 2025

As San Diego headed into the Labor Day weekend, the real estate market sent some classic signals of a seasonal transition. At first glance, the data shows a significant 25% jump in closed sales for single-family homes, which might suggest a heating-up market. However, it is crucial to understand that this is a lagging indicator, reflecting the spike in buyer activity from about a month ago, not a new surge in demand.

The real story lies in the leading indicators. The number of new listings and new pending sales are showing signs of a typical seasonal slowdown as families settle into back-to-school routines. This trend may be amplified by the holiday weekend, which often sees a temporary pause in activity. This all comes as the broader market holds its breath for clearer economic signals. Potential homebuyers are highly sensitive to any news that could influence future mortgage rates, which is keeping the market in a state of careful observation.

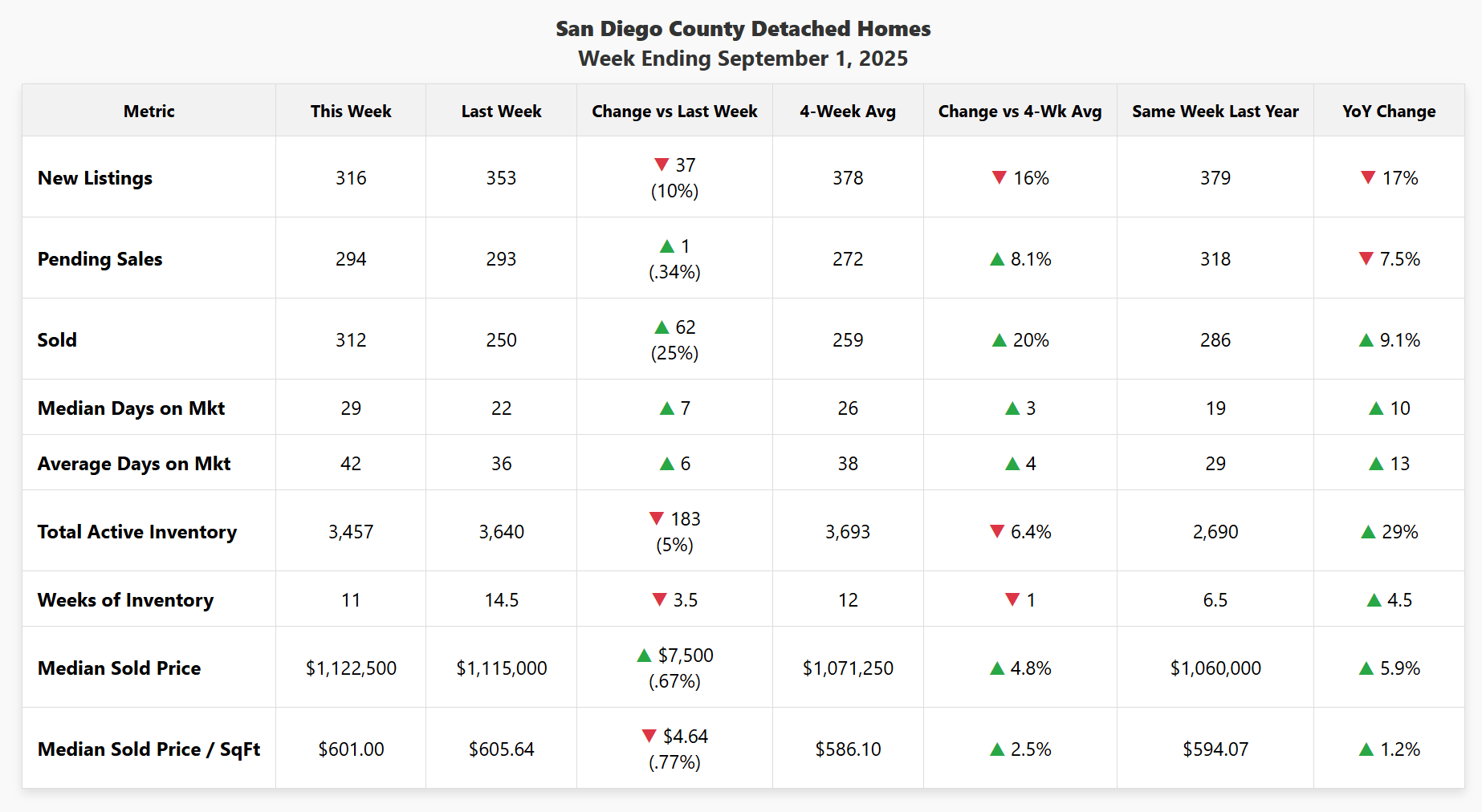

🏠 DETACHED HOMES – Week Ending September 1, 2025

Data for San Diego County detached homes for the week ending September 1, 2025. Source: SDMLS | Analysis by Matt O'Brien, Realtor.

While closed sales jumped 25%, a more telling number is the Median Days on Market for those sold properties, which was 29 days. This confirms that these are older deals. To understand today's market, we have to look at this week's newly pending sales. Here, the number held steady, and the Median Days on Market to Pending was 23 days. This tells us that well-priced homes are still moving quickly. At the same time, fewer sellers are coming to the market, with new listings down 10%. This is a typical seasonal trend, but one to watch as it will impact inventory levels.

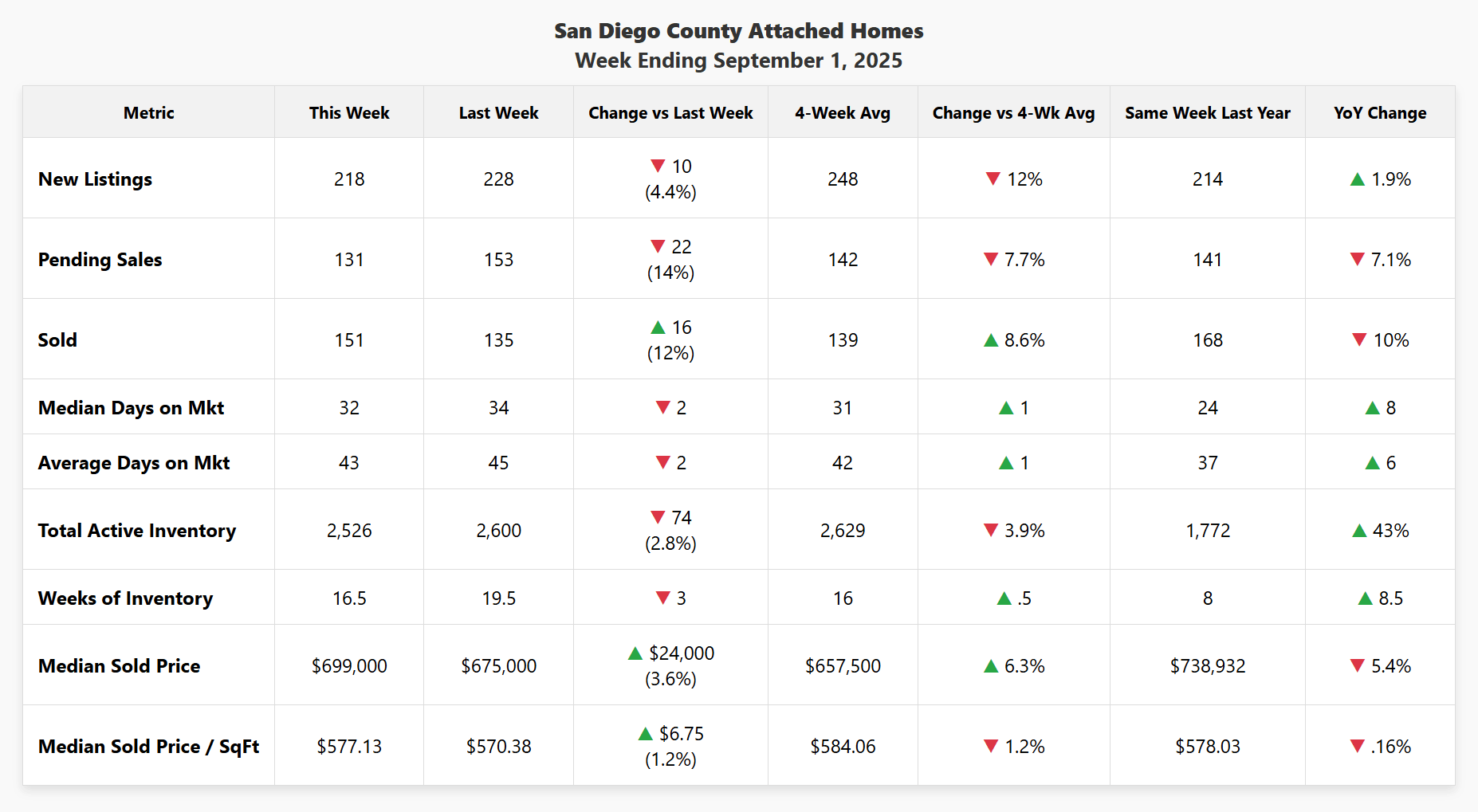

🏢 ATTACHED HOMES (Condos/Townhomes) – Week Ending September 1, 2025

Data for San Diego County attached homes for the week ending September 1, 2025. Source: SDMLS | Analysis by Matt O'Brien, Realtor.

The attached market is showing a clearer seasonal slowdown, with new pending sales dropping by 14%. This is a significant pullback in new buyer activity that may be influenced by the upcoming holiday weekend. It's also a great example of how different "Days on Market" metrics tell different stories. The Median DOM for properties that sold was 32 days, but the Median DOM to Pending was 29 days. This can happen when a property falls out of escrow and goes back on the market before finally closing. It shows that while some transactions are taking longer, new, well-priced listings are still moving.

💡 What This Means for You

🔵 For Buyers

This is a market of opportunity. The headline "surge" in closings is not reflective of the current level of competition. The 14% drop in new pending condo sales shows that the typical fall slowdown is beginning, giving you more breathing room. With inventory still 29-43% higher than last year, you are in a great position to negotiate.

🟢 For Sellers

It's crucial to understand that this week's high number of closings is an echo of the past, not a signal of the present. The leading indicators show that buyer demand is softening as we enter the fall season. Your pricing and marketing must be sharp to capture the attention of the serious buyers who are still in the market.

🟠 For Homeowners

Your equity position remains strong. The market is showing signs of a healthy and normal seasonal adjustment. The high number of closed sales, even as a lagging indicator, confirms that there is still a deep pool of qualified buyers who are able to transact in the current rate environment.

💰 For Investors

The seasonal slowdown, particularly in the attached market, is a trend to watch closely. As we move deeper into the fall, a decrease in competition could lead to more opportunities to acquire properties from sellers who are motivated to close before the end of the year.

📞 Ready to Make Your Move?

Understanding the difference between leading and lagging indicators is the key to making a smart decision in this complex market. If you're ready to build a strategy based on what's happening now, not a month ago, let's connect.

Let's Talk StrategyCategories

Recent Posts