Has San Diego's Seasonal Real Estate Cooldown Officially Begun?

Has San Diego's Seasonal Real Estate Cooldown Officially Begun?

San Diego Housing Market Update – Week Ending August 3, 2025

This week may have given us a potential signal that the San Diego housing market is entering its typical late-summer cooldown. After some volatility in recent weeks, key indicators for new buyer activity have softened, suggesting the market is beginning its seasonal shift as families prepare for back-to-school season. This is a crucial trend to keep an eye on to see if it continues. Barring any dramatic changes to interest rates—which are currently hovering in the high 6% range for a 30-year fixed loan in California—this calmer, more balanced market is likely the trend we'll see through the end of the year.

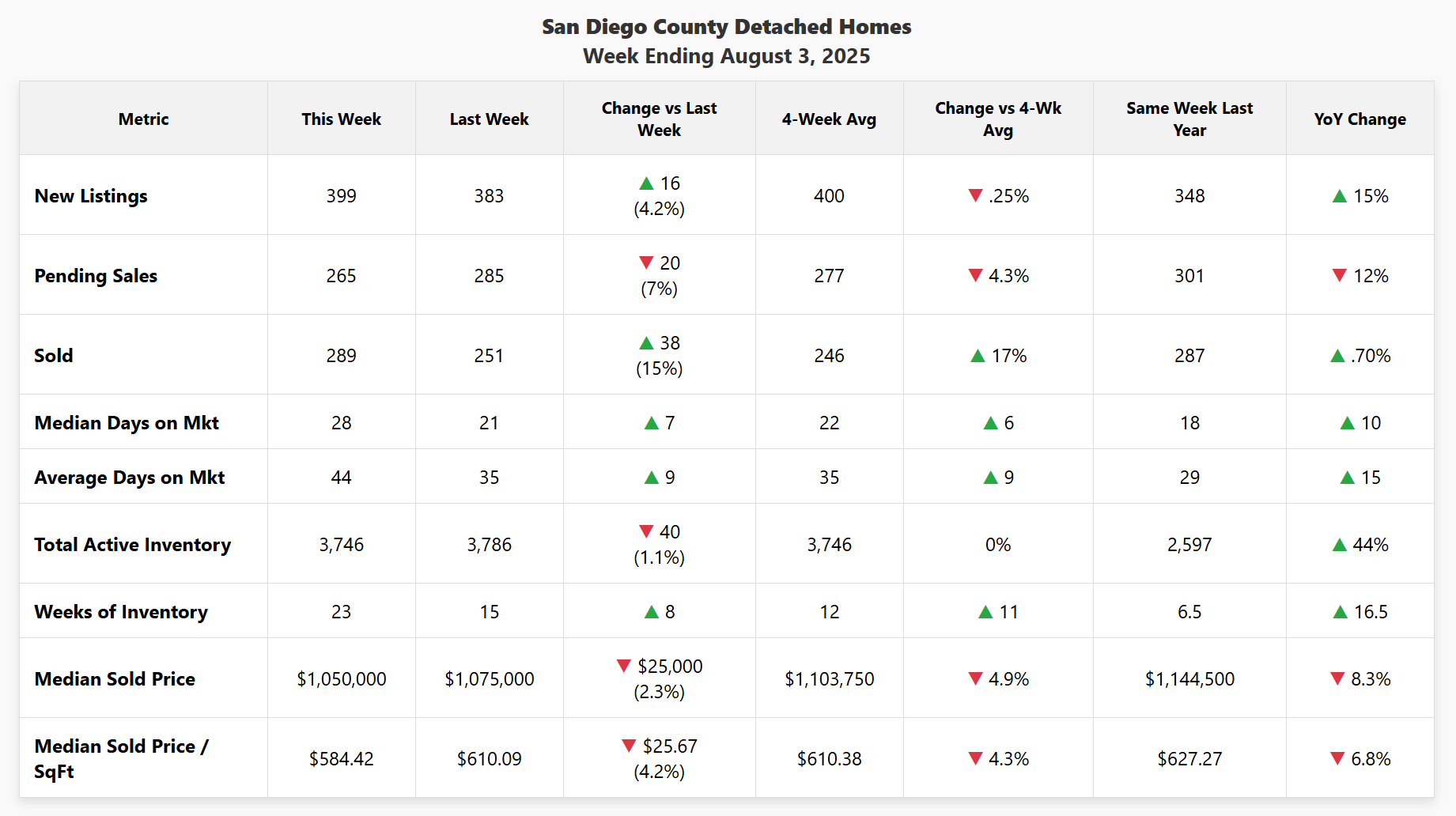

🏠 DETACHED HOMES – Week Ending August 3, 2025

Data for San Diego County detached single-family homes. Source: SDMLS | Analysis by Matt O'Brien, Realtor.

At first glance, the detached homes market shows some mixed signals. The number of closed sales was strong, up 15% from last week, reflecting deals that were likely struck 30-45 days ago. However, the more important leading indicators point towards a slowdown. Pending sales, which represent current buyer demand, dipped by 7% this week. This suggests that the robust closing numbers may not persist as we move into the fall.

The median sold price this week is down 8.3% compared to the same week last year, a significant data point. However, it’s important to view this in context; prices were lower at several points earlier in 2025. This indicates less of a sharp decline and more of a market normalization, influenced by inventory levels that remain a remarkable 44% higher than a year ago.

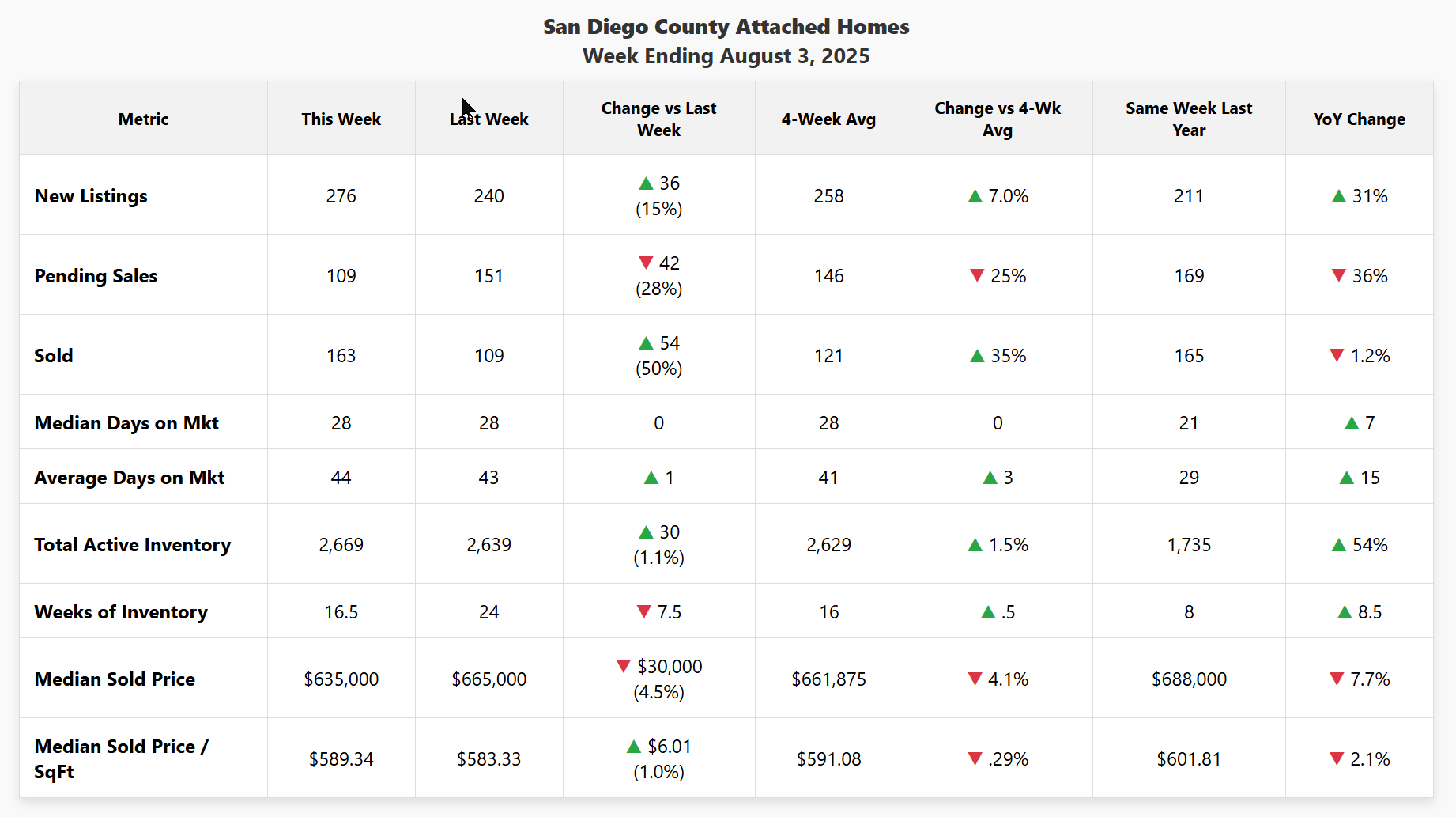

🏢 ATTACHED HOMES (Condos/Townhomes) – Week Ending August 3, 2025

Data for San Diego County attached homes (condos/townhomes). Source: SDMLS | Analysis by Matt O'Brien, Realtor.

The cooldown in the attached market was much more pronounced. Buyer demand saw a dramatic pullback, with pending sales falling 28% in a single week. This is a significant signal that buyers in this segment are becoming more cautious and selective, especially in the face of mortgage rates in the high 6s.

This sharp drop in demand is happening while inventory remains 54% higher than last year, giving buyers abundant choice. The sustained pressure has resulted in a 7.7% year-over-year drop in the median sold price, reinforcing the theme that this market segment is rebalancing.

💡 What This Means for You

🔵 For Buyers

This is a strong signal that the market has shifted more in your favor. Year-over-year price adjustments, falling demand, and high inventory create an environment with more opportunity. However, it's important to understand this doesn't mean the competition has vanished. Many turn-key and unique properties that are priced correctly are still getting multiple offers and moving very quickly. This week, approximately 30% of single-family homes that went into escrow were on the market for 10 days or less. For condos and townhomes, that figure was about 25%. This means that while you have more power, being prepared and ready to act on the right property is still key to success.

🟢 For Sellers

It’s crucial to acknowledge the seasonal shift. The market is normalizing, and pricing your home in line with today's values, not those from a few months ago, is the key to a successful sale. With buyer demand softening, a sharp pricing strategy is your most powerful tool. It's the key to attracting strong offers and selling within that competitive 7-to-10-day timeframe.

🟠 For Homeowners

Your equity position remains strong, but this seasonal cooldown is a reminder that the explosive appreciation of the last few years has passed. This period of normalization is a healthy sign for the long-term stability of the market.

💰 For Investors

The cooling demand and significant inventory create potential acquisition opportunities, particularly in the attached market where prices have already seen a year-over-year correction. This is a market that favors long-term hold strategies over short-term flips, which now carry substantially more risk.

📞 Ready to Make Your Move?

A normalizing market requires a nuanced strategy. Whether you're buying, selling, or investing, understanding these shifts is key to making a smart decision. If you're ready to build a plan for this market, let's connect.

Let's Talk StrategyCategories

Recent Posts