Post-Holiday Rebound: A 62% Surge in New Listings Shakes Up San Diego

Post-Holiday Rebound: A 62% Surge in New Listings Shakes Up San Diego

San Diego Housing Market Update – Week Ending July 13, 2025

Last week, I hinted that the market lull was likely due to the Fourth of July holiday, and this week's data proves that theory correct. It looks like sellers are back at it after taking some time off for the holiday week, flooding the market with a massive 62% rebound in new single-family home listings. This post-holiday surge, however, was met with a slight cooldown in buyer activity, creating an interesting new dynamic and some of the best opportunities for buyers I’ve seen in years. Let's break down the official numbers.

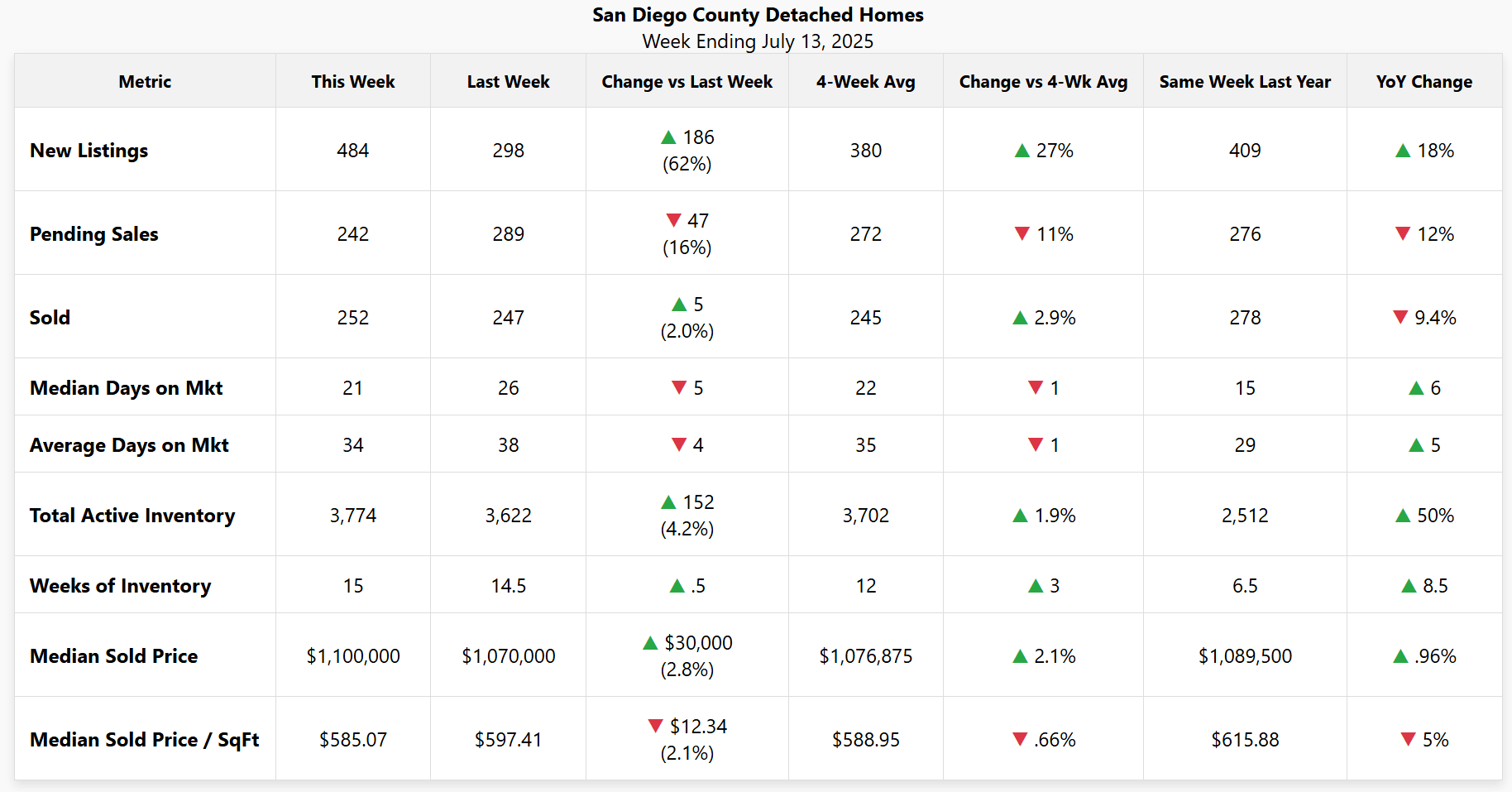

🏠 DETACHED HOMES – Week Ending July 13, 2025

Data for San Diego County detached single-family homes. Source: SDMLS | Analysis by Matt O'Brien, Realtor.

The big headline for detached homes is the dramatic post-holiday rebound in supply. After a quiet holiday week, new listings shot up 62%, a massive move that gives buyers significantly more to look at. This surge contributed to the overall supply of homes for sale climbing to 3,774—a whopping 50% higher than this time last year. For buyers, this is a welcome sight.

However, demand didn't quite keep pace. The number of homes going into escrow (pending sales) fell by 16% this week. It's possible that some of the buyers are still on vacation or in the middle of negotiations from the holiday week. I'll be watching to see if there's a jump in next week's pending sales or if this softening is a continuing trend. Still, prices are holding firm, with the median sold price climbing 2.8% week-over-week to $1.1M.

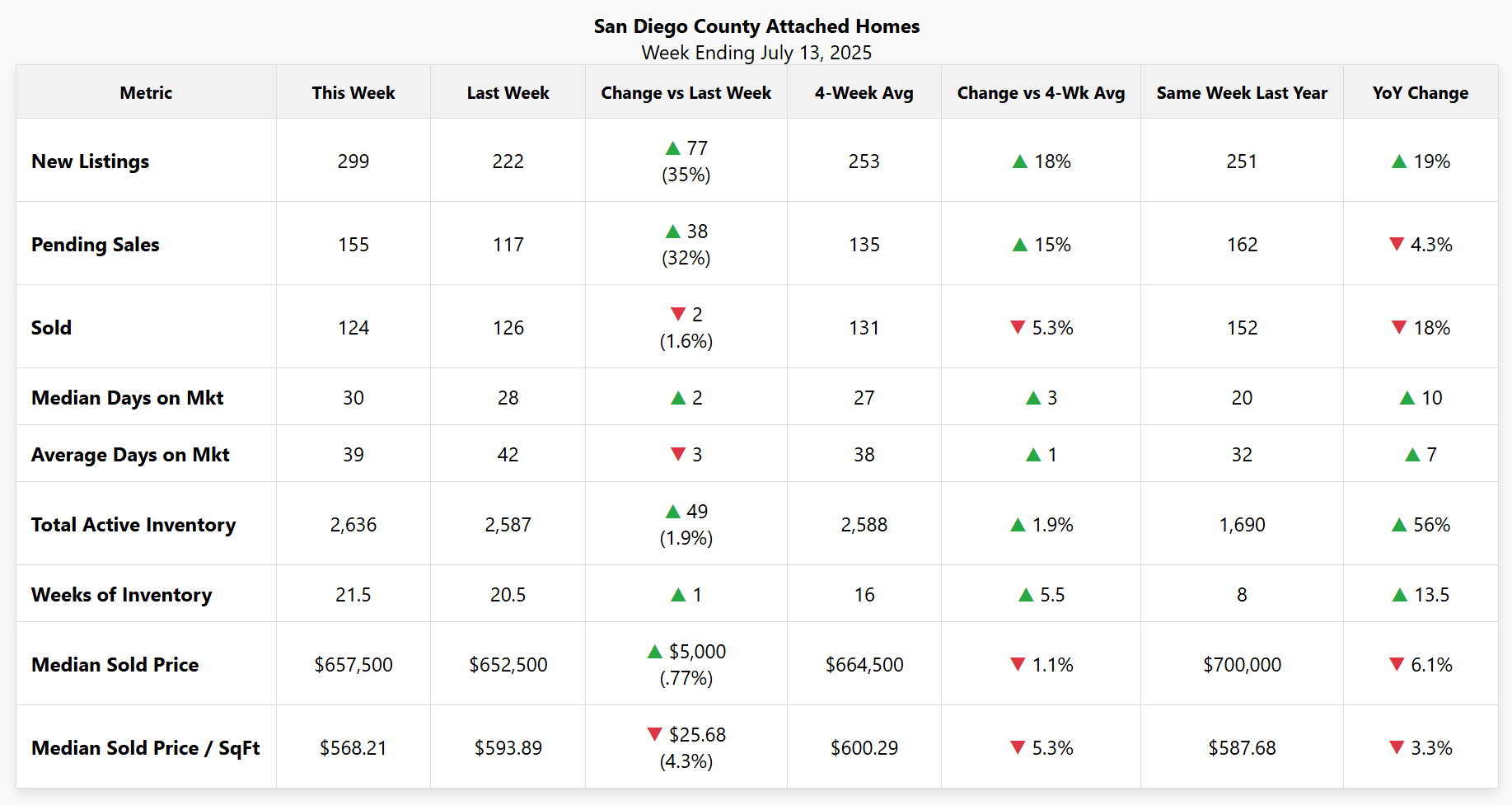

🏢 ATTACHED HOMES (Condos/Townhomes) – Week Ending July 13, 2025

Data for San Diego County attached homes (condos/townhomes). Source: SDMLS | Analysis by Matt O'Brien, Realtor.

The attached market saw a similar story with new listings, which jumped by 35% week-over-week. But it looks like the buyers for condos and townhomes didn't take a long holiday break, because pending sales surged right alongside the new inventory with a 32% gain. This flurry of activity shows that as single-family home prices remain high, many buyers and sellers are active in the more accessible attached market.

Inventory for attached homes is now 56% higher than it was last year. While all this new activity is happening, the median sold price actually dipped slightly by 1.1% compared to the four-week average, landing at $657,500. This suggests that while demand is strong, the sheer volume of listings is keeping prices competitive.

💡 What This Means for You

For Buyers

This is the moment to be active. The surge in new listings, combined with a total inventory that's over 50% larger than last year, means you have choices. You can afford to be more selective and negotiate more effectively. With more homes to see, you're more likely to find one that truly fits your needs without having to compromise on every point.

For Sellers

The market requires a strategic approach. The massive increase in active inventory means you are competing with more sellers for a buyer pool that is still sensitive to price and interest rates. To stand out, you need to be sharp on price and perfect on presentation right from day one.

For Homeowners

The value of your home remains historically high, with the median detached price at $1.1M. However, the market dynamics are changing fast. The rapid inventory growth signals a return to a more balanced market, where price growth will likely be more moderate. It’s an excellent time to get a professional evaluation to understand my current equity position.

📞 Ready to Make Your Move?

These numbers tell a story, but your story is unique. Whether you're a buyer seeing opportunity, a seller needing a new strategy, or a homeowner curious about their equity, I can provide the clarity you need.

Let's Talk StrategyCategories

Recent Posts